ufa656.site

Recently Added

Trend Auto Trader

Trend Auto Trader Vehicles For Sale - DealerRater | Page 4. Auto Trader Group annual/quarterly revenue history and growth rate from to Revenue can be defined as the amount of money a company receives from. Browse cars and read independent reviews from Trend Auto Trader Inc. in Quakertown, PA. Click here to find the car you'll love near you. Trend Auto Trader in Quakertown Pa, everything we do revolves around you and providing best car buying experience. Once you've chosen your next car, our. Trend Auto Trader Inc. Automotive Repair Shop. Open until PM. S West End Blvd, Quakertown, PA , United States · Directions Directions. The company's successful transformation from print to digital reflects a general trend in the automotive sector and in retail as a whole, driven by shifts in. Trend Auto Trader, Inc. Used Car Dealers. Contact Information S West End Blvd Quakertown, PA () Don't let the name fool you, this #avalanche is not only ideal for weathering the icy roads it is also the perfect vehicle to pack up and. Read verified reviews and shop used car listings that include a free CARFAX Report. Visit Trend Auto Trader Inc in Quakertown, PA today! Trend Auto Trader Vehicles For Sale - DealerRater | Page 4. Auto Trader Group annual/quarterly revenue history and growth rate from to Revenue can be defined as the amount of money a company receives from. Browse cars and read independent reviews from Trend Auto Trader Inc. in Quakertown, PA. Click here to find the car you'll love near you. Trend Auto Trader in Quakertown Pa, everything we do revolves around you and providing best car buying experience. Once you've chosen your next car, our. Trend Auto Trader Inc. Automotive Repair Shop. Open until PM. S West End Blvd, Quakertown, PA , United States · Directions Directions. The company's successful transformation from print to digital reflects a general trend in the automotive sector and in retail as a whole, driven by shifts in. Trend Auto Trader, Inc. Used Car Dealers. Contact Information S West End Blvd Quakertown, PA () Don't let the name fool you, this #avalanche is not only ideal for weathering the icy roads it is also the perfect vehicle to pack up and. Read verified reviews and shop used car listings that include a free CARFAX Report. Visit Trend Auto Trader Inc in Quakertown, PA today!

At this year's Car Dealer Live conference, we shared our thoughts on the three big trends we believe will shape the new and used car market in and beyond. 29 Followers, 46 Following, 21 Posts - Trend Auto Trader Inc (@trendautotraderinc) on Instagram: "▪️Family-Owned Used Car Dealership Located in Quakertown. “New vehicle inventories in Canada at record high: AutoTrader”. Auto Having a look at the Tesla trend was mind blowing. It's waaay down. Investors are usually either trend followers or contrarians. The former seek to buy stocks that have risen rapidly in the hope of benefitting from a. South West End Boulevard Quakertown, PA · Visit Trend Auto Trader · () () New & Used, New & Certified, New, Used. UNSURE WHICH VEHICLE YOU ARE LOOKING FOR? FIND IT HERE ; Ford Fiesta 5-Door T Trend Auto. R ,,KM ; GWM P-Series TD Double Cab LS. R ,, Find out what works well at Trend Auto Trader from the people who know best. Get the inside scoop on jobs, salaries, top office locations, and CEO insights. Trend Auto Trader Inc. Automotive Repair Shop. Open until PM. S West End Blvd, Quakertown, PA , United States · Directions Directions. Trend Auto Trader Inc. S WEST END BLVD. Quakertown, PA Bucks County. Phone Number: OIS Number: AI Search on Google. Inventory for Trend Auto Trader Inc in Quakertown, PA Find cars for sale by Trend Auto Trader Inc on MyNextRide. ID Browse our new, used and preowned cars for sale at TREND AUTO TRADER INC in Quakertown, PA Find your dream car, customize your payment and. TREND AUTO TRADER | | South West End Boulevard, Quakertown, Pennsylvania | ufa656.site | Find new and used. Trend Auto Trader in Quakertown Pa, everything we do revolves around you and providing best car buying experience. Once you've chosen your next car, our. Trend Auto Trader (@trendautotrader) on TikTok | Likes. 51 Followers. Watch the latest video from Trend Auto Trader (@trendautotrader). Don't let the name fool you, this #avalanche is not only ideal for weathering the icy roads it is also the perfect vehicle to pack up and head out for an. Auto Trader Group annual/quarterly revenue history and growth rate from to Revenue can be defined as the amount of money a company receives from. Based on these figures and the overall annual trend Auto Trader is Demand for used cars remains strong despite cost of living crisis – says. Reviews from Trend Auto Trader employees about Trend Auto Trader culture, salaries, benefits, work-life balance, management, job security, and more. That trend continued into January and February with even more record sales auto shows and automotive trends. ufa656.site operates two other auto.

How To Book Connecting Flights With Different Airlines

Skyscanner's flight search will help you find cheap plane tickets by searching dozens of different airlines. Pick the flight and carrier that best suits. How to Book Cheap Flights? · Fly during the working week · Have a look at airline websites · Consider flights with less-popular departure times · Find a better. Booking connecting flights with different airlines is easy with Alternative Airlines' multi-stop flights tool. To find out how to book your flight with. You may not need a transit visa. For more information on eligibility requirements for travellers, airlines, and airport authorities visit Transit through Canada. But you don't have to find partner airlines, just go to the airline you want to fly, enter depart/arrival info, and they will appear. Upvote. You should be careful if you will fly with two different airline companies. There are interline baggage agreements between the airlines. If they have an. Self-Connect is where you book separate tickets with more than one airline. While this approach may give you greater flexibility and possibly work out cheaper. If you are using two different airlines, please check with your airline for information. Arriving international connecting to domestic. Passengers arriving. How can I get my Luggage Checked Through? · Find out About Agreements · Contact the airline · Factor in Some Extra Time at the Airport · Gather all the Information. Skyscanner's flight search will help you find cheap plane tickets by searching dozens of different airlines. Pick the flight and carrier that best suits. How to Book Cheap Flights? · Fly during the working week · Have a look at airline websites · Consider flights with less-popular departure times · Find a better. Booking connecting flights with different airlines is easy with Alternative Airlines' multi-stop flights tool. To find out how to book your flight with. You may not need a transit visa. For more information on eligibility requirements for travellers, airlines, and airport authorities visit Transit through Canada. But you don't have to find partner airlines, just go to the airline you want to fly, enter depart/arrival info, and they will appear. Upvote. You should be careful if you will fly with two different airline companies. There are interline baggage agreements between the airlines. If they have an. Self-Connect is where you book separate tickets with more than one airline. While this approach may give you greater flexibility and possibly work out cheaper. If you are using two different airlines, please check with your airline for information. Arriving international connecting to domestic. Passengers arriving. How can I get my Luggage Checked Through? · Find out About Agreements · Contact the airline · Factor in Some Extra Time at the Airport · Gather all the Information.

Book US to India business class flight tickets on Flyopedia and know all about what a connecting flights entails. If you've booked two flights separately, in most cases you'll need to pick up your checked bags and check-in for your connecting flight. If so, simply exit. Search for multi-destination flights on United and more than 80 airlines. Find adult, senior, child and pet fares, and use money or miles to book. Book on a single ticket In case of any difficulty during traveling with the single airline regarding destination or place then you can opt the codeshare or. You are responsible for fixing/rebooking your connecting flight not the airline. Some airports do offer services that assist with this type of situation. To search and book flights that connect different airlines, use our search form at the top of the page. Choose to fly between any two destinations — we'll do. If you can do so, we strongly recommend not booking two separate tickets on two different airlines. The concept of a `minimum connecting time` only exists with. If your itinerary is with different airlines, each flight ticket has its Free Baggage Allowance policy, which may not necessarily apply to connecting flights. Passengers connecting between certain member airlines and a Connecting Partner under a single booking may enjoy certain comforts and privileges. All passengers. If you've booked your flight on two different tickets with different airlines, you'll need to collect your luggage and check it in at the connecting city. If. If your Flight search results include multiple airlines in each itinerary book separately through each airline, you're probably seeing an interline. Stick to Single Ticket Trip book connecting flights with different airlines, connecting flights work, connecting flights international, connecting. One must. If you have one booking reference (tickets reserved with the same airline or partner airlines). Go to the boarding gate for your next flight by following. For customers holding a separate ticket for down-line connecting flights booked in the same PNR,. American will continue to through-check bags exclusively to. This saves you a lot of time when you're booking because you're no longer searching for separate, one way tickets between each individual city. If the airlines. If you can do so, we strongly recommend not booking two separate tickets on two different airlines. The concept of a `minimum connecting time` only exists with. Use Multi-City to book a trip between two different origin or destination cities. To book a stopover itinerary, please contact our help desk. Some itineraries include multiple airlines that may not have a baggage partnership, and you may need to claim and recheck your bags. While rare, the connecting. If you haven't received it, you can go to the transfer desk or kiosk of the airline you're flying with to collect it. Baggage transfer. For most transfers, you. This allows you to mix and match airlines on the same route and book multiple stopovers in different locations. Multi-City Flight Bookings. Rather than booking.

Hard Teflon

We work hard to protect your security and privacy. Our payment security system encrypts your information during transmission. We don't share your credit. The ultimate protection for plastics, gelcoats and laquered surfaces! The premium hard wax with Teflon® surface protection lasts much longer than. The hard Teflon gasketing protects against excessive compression of the Membrane Electrode Assembly (MEA), and hence greater sealing pressures can be achieved. Features a standard serrated handle with Hard teflon tip. Special engaging slot prevents chipping silicon and gallium wafers. Made of premium anti-magnetic. Platinum Teflon Hard Card - GTPLT. $ Out of stock. OUT OF STOCK. Awaiting product image. Product Categories. Bray Windshield Skin. Description. The Teflon™ squeegee is extremely rigid and helps eliminate cupping. The Teflon™ will not allow cyanoacrylates (superglue) as well as other. Ptfe is extremely slick, and dimensional tolerance is sometimes hard to hold and changes over time after machining in the environment. If I. Atbk, ProToolsNow 4" black hard card. The ProToolsNow 4" Black Teflon Card is second to the white hard card in popularity. This card provides a little. The Gold Teflon card is harder than the Black Teflon card. This particular window tinting tool is a great choice for heat shrinking rear windows. We work hard to protect your security and privacy. Our payment security system encrypts your information during transmission. We don't share your credit. The ultimate protection for plastics, gelcoats and laquered surfaces! The premium hard wax with Teflon® surface protection lasts much longer than. The hard Teflon gasketing protects against excessive compression of the Membrane Electrode Assembly (MEA), and hence greater sealing pressures can be achieved. Features a standard serrated handle with Hard teflon tip. Special engaging slot prevents chipping silicon and gallium wafers. Made of premium anti-magnetic. Platinum Teflon Hard Card - GTPLT. $ Out of stock. OUT OF STOCK. Awaiting product image. Product Categories. Bray Windshield Skin. Description. The Teflon™ squeegee is extremely rigid and helps eliminate cupping. The Teflon™ will not allow cyanoacrylates (superglue) as well as other. Ptfe is extremely slick, and dimensional tolerance is sometimes hard to hold and changes over time after machining in the environment. If I. Atbk, ProToolsNow 4" black hard card. The ProToolsNow 4" Black Teflon Card is second to the white hard card in popularity. This card provides a little. The Gold Teflon card is harder than the Black Teflon card. This particular window tinting tool is a great choice for heat shrinking rear windows.

Features a standard serrated handle with hard teflon tip. Special engaging slot prevents chipping silicon and gallium wafers. Made of premium anti-magnetic. The Teflon Hard Card is a durable, rigid tool designed for precision application and smoothing of films and tints on various surfaces. Black Teflon Hard Card - GTBLK · One of the most popular lines of hard card squeegees because they are available in different flex / hardness levels. Commonly. TEFLON GOLD HARD CARD SQUEEGEE - MT - SQUEEGEEING - Teflon Gold Hard Card Squeegee 10 cm medium in stiffness on our flexibility scale, which makes it. Versatile line of Teflon hard cards for Tint, PPF & Vinyl installation. Also used for heat shrinking. Available in different hardness / flex levels. #1 Thrust Bearing. "Hard Teflon" 1/8" OD for 1/32" shaft. Pack of 6. Shipping. UK SHIPPING. Most orders are shipped via Royal Mail's Tracked 48 service. hard fabric - SheetsPertinax (Hard paper) - SheetsRemaining PiecesRods PTFE Teflon Sheet blank Polytetrafluorethylene 0,5 to mm (dim. Teflon is a hard material Contrary to popular belief, PTFE is very flexible. In fact, it is so pliant that it can easily be deformed by hand. It is therefore. Pioneer's Hard Lube process produces a hardcoat finish that is combined with a proprietary PTFE process to improve the lubricity of the hardcoated surface. The. atw ProToolsNow 4" white hard card. The WHITE TEFLON CARD is probably the most popular hard card in the industry. This card is just slightly stiffer. Versatile line of Teflon hard cards for Tint, PPF & Vinyl installation. Also used for heat shrinking. Available in different hardness / flex levels. The resultant coating offers the dense, hard protection of Type III hardcoat anodizing coupled with the excellent dry lubrication for which PTFE is so well. The hardest of the “Teflon Group”. 4′′ Platinum Teflon Card is ideal for heat shrinking because it resists meltdown when exposed to heat. Self Adhesive Teflon Hard Sheet Plastic PTFE Plate, Find Details about PTFE, Outer Ring from Self Adhesive Teflon Hard Sheet Plastic PTFE Plate - Wenzhou. Constructed with heavy gauge anodized aluminum for durability and even heat distribution throughout the sides and bottom of the pan, Viking Hard Anodized. The Blue Teflon is much softer than the other teflon hard cards. This tool is used primarily for paint protection film and vinyl graphic installations or. Material ; Premier™ Space-Saving Hard-Anodized Nonstick Cookware, Piece Pots and · ; Premier™ Hard-Anodized Nonstick Frying Pan Set, Inch and · 4" WHITE TEFLON HARD CARD SQUEEGEE. 4" WHITE TEFLON HARD CARD 4" BLACK TEFLON HARD CARD 4" BLUE TEFLON HARD CARD 4" PLATINUM TEFLON CARDS 4" GOLD TEFLON HARD CARD 4" PURPLE TEFLON HARD CARD. Teflon can be used in a a variety of applications having a combination of mechanical, electrical, chemical, temperature and anti-friction properties that are.

What Is A Bank Transfer Credit Card

What is a balance transfer? You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee. A balance transfer is when you move credit card debt from a high-interest card to a zero-interest card to save money. Sounds simple enough, and if you're. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a card. A balance transfer credit card lets you move what you owe from one or more credit cards to a new one with a different provider. Because it typically has a lower. Enjoy 0% interest period on balance transfers for up to 27 months with the Balance Transfer Credit Card from Tesco Bank. Find out more and apply today! A balance transfer is when you move money you owe from one credit card to another that charges less in interest. A balance transfer is when you move your existing credit card balance(s) to another credit card with a different provider. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. Balance transfer credit cards offer low introductory APRs that can help you pay your balance down faster. What is a balance transfer? You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee. A balance transfer is when you move credit card debt from a high-interest card to a zero-interest card to save money. Sounds simple enough, and if you're. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a card. A balance transfer credit card lets you move what you owe from one or more credit cards to a new one with a different provider. Because it typically has a lower. Enjoy 0% interest period on balance transfers for up to 27 months with the Balance Transfer Credit Card from Tesco Bank. Find out more and apply today! A balance transfer is when you move money you owe from one credit card to another that charges less in interest. A balance transfer is when you move your existing credit card balance(s) to another credit card with a different provider. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. Balance transfer credit cards offer low introductory APRs that can help you pay your balance down faster.

Best Balance Transfer Cards of August ; Citi® Diamond Preferred® Card · Citi® Diamond Preferred® Card · % - % Variable ; Citi Rewards+® Card · Citi. In this article, we will discuss everything you need to know about bank transfers with a credit card, including the benefits, drawbacks, and how to go about it. The purpose of a balance transfer is to help you pay off your debt. This means paying as little interest as possible. For example, if a card has an introductory. It is possible to transfer money from a credit card to a debit card, but there are several things you need to take into account first. A balance transfer credit card lets you transfer a balance from a higher-interest card to a new or existing credit card with a lower interest rate or temporary. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. Learn the definition of a wire transfer, what a credit card wire transfer is, and how to do a wire transfer. It's essentially transferring your credit card debt to another card with zero percent (or low) rates that allow you to whittle down the debt without paying. 3% of each transaction intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all. A money transfer is when you transfer funds from a credit card directly to a bank account for use on purchases. With a Wells Fargo balance transfer credit card, you can pay off higher interest rate balances, cover planned or unexpected expenses, and simplify your. Is a balance transfer available for your Wells Fargo credit card? Check Now. Call or visit a Wells Fargo location. A balance transfer is when you move outstanding debt from one credit card to another. Balance transfers are typically used by consumers. A balance transfer involves moving outstanding debt from one credit card to another card—typically, a new one. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. A balance transfer is a transaction that enables you to move existing debt to a new credit card. The purpose of a balance transfer is to get a lower interest. A balance transfer fee is a charge imposed by a lender to transfer existing debt over from another institution. Credit card companies commonly offer balance. A balance transfer is a method of debt consolidation where you combine existing credit card debt and other qualifying debts within one single credit card. This. Learn about balance transfer credit cards, how they work, how to apply, and if you should get a balance transfer card to help pay off your credit card debt.

Inexpensive Merchant Services

When you receive your statement each month, you will always pay zero. Finally, a solution that completely eliminates merchant service fees. At Shift, we reduce. Merchants can apply and are approved for a merchant account within the same day. Superior Customer Service along with 24/7 Technical Support. Our Technical. The best way to get the cheapest credit card processing is to use membership pricing, flat fee pricing, or interchange plus (cost plus) pricing. Other credit card merchants may offer cheap merchant services and low rate credit card processing while locking you into a long-term contract & costly. Blackbaud Merchant Services is designed to save you money and make payment processing affordable. Eliminate processing fees with Complete Cover™, which lets. Flagship Merchant Services is a full-service payment processing company that allows merchants to take payments online, in person, by mail and over the phone. Blackbaud Merchant Services provides a streamlined payment processing solution so you can spend more time on your organization's mission. We'll beat the rates of ANY other merchant processor, without hidden fees. Receive all your transactions on a page, easy to understand statement. A “good” merchant service rate is the lowest you can possibly find. But if you are stuck between several different options and they all seem to cost about. When you receive your statement each month, you will always pay zero. Finally, a solution that completely eliminates merchant service fees. At Shift, we reduce. Merchants can apply and are approved for a merchant account within the same day. Superior Customer Service along with 24/7 Technical Support. Our Technical. The best way to get the cheapest credit card processing is to use membership pricing, flat fee pricing, or interchange plus (cost plus) pricing. Other credit card merchants may offer cheap merchant services and low rate credit card processing while locking you into a long-term contract & costly. Blackbaud Merchant Services is designed to save you money and make payment processing affordable. Eliminate processing fees with Complete Cover™, which lets. Flagship Merchant Services is a full-service payment processing company that allows merchants to take payments online, in person, by mail and over the phone. Blackbaud Merchant Services provides a streamlined payment processing solution so you can spend more time on your organization's mission. We'll beat the rates of ANY other merchant processor, without hidden fees. Receive all your transactions on a page, easy to understand statement. A “good” merchant service rate is the lowest you can possibly find. But if you are stuck between several different options and they all seem to cost about.

Helcim offers easy, low-cost credit card processing designed for small business. Learn more about our radically transparent pricing model. Easy Pay Direct is the leading cheap merchant account provider for high risk businesses. We offer transparent pricing and no early termination fees. For high. 20 is dirt cheap, and $ per transaction charge is also really low. What's the Catch?: You'll discover extra fees for all optional services and equipment. National Processing is a credit card processing company targeted at low-risk merchants. Under its differential pricing structure, restaurants pay the lowest. % of merchant fees gone forever with no monthly fees. % free terminals. Month-to-month contracts on all accounts. Available in all 50 states. Elite Merchant Services makes it easy and affordable to accept credit card payments. Learn More · Guaranteed Lowest Prices in the ATM Industry. ATM Services. Bay State Merchant Services provides affordable credit and debit card processing with free equipment and low rates. With “no fees processing”, you can begin. With your own merchant account, there will be different types of fees, but you will get customized – and often times more competitive – rates and plans. You. Our rates of % and $ per transaction above Interchange (including AVS!) are some of the lowest out there. Pricing for eCommerce merchant services can be. Merchant account providers are notorious for high markups and hidden fees. With Stax, you'll never be charged unnecessary fees. Stax offers subscription-based. Fortunately, there's a way to strike a balance and get decent rates while still getting top-of-the-line products and services from your merchant account. You'll get a merchant account and payment gateway so you can accept e-commerce payments on your website, a virtual terminal to take orders over the phone, and. With the help of a merchant service provider, a business can ensure online processing of credit card payments without redirecting customers to a third-party. Learn more about Wells Fargo merchant services credit card processing fees, and better understand what your small business could pay in a typical month. Cheapest Deals. We have some of the best and exclusive rates from our Merchant Services Mastery. Merchant Services Mastery: A Comprehensive Guide. Square uses a flat-rate pricing model with no monthly fees. The company's fees are as follows: Square is best for lower-volume merchants that process less. Square for Mobile Businesses · Stripe for Online Businesses · PayPal for Low-Volume Retailers · Payline Data for $5,+ per Month · Dharma Merchant Services for. Optimize your business with National Processing's secure, efficient merchant and credit card processing. Tailored solutions and competitive rates for. You will be able to tell by if you get the actual merchant account number and they go through vetting so you will fill out some paperwork. If. If you want to grow your business and maximize your sales, a credit card merchant account is a necessity, not an option for your business! And if you want the.

Bank Stock Price Today

Stock Quote. NASDAQ: FCNC.A FCNC.B. Price, $1,, Volume, 29, Change, +, % Change, +%. Today's Open, $1,, Previous Close, $1, Bank of America Corp. · AT CLOSE PM EDT 08/23/24 · USD · % · Volume45,, Bank of America's stock price is currently $, and its average month price target is $ Wells Fargo's stock price is currently $, and its. Today ; Last. ; Volume. m ; $ Chg. ; % Chg. % ; Open. Community Bank System | CBUStock Price | Live Quote | Historical Chart ; United Bankshares, , , % ; United Community Banks, , , %. Key facts today. Berkshire Hathaway has cut its stake in Bank of America Corp. (BAC) and Apple. After. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta Price. $ · Volume. , · Change. + · % Change. +% · Today's Open. $ · Previous Close. $ · Intraday High. $ · Intraday Low. $ Day High, Day Low, Week High, Week Low, Stock Chart. Sign up for email alerts. Data Provided by Refinitiv. Stock Quote. NASDAQ: FCNC.A FCNC.B. Price, $1,, Volume, 29, Change, +, % Change, +%. Today's Open, $1,, Previous Close, $1, Bank of America Corp. · AT CLOSE PM EDT 08/23/24 · USD · % · Volume45,, Bank of America's stock price is currently $, and its average month price target is $ Wells Fargo's stock price is currently $, and its. Today ; Last. ; Volume. m ; $ Chg. ; % Chg. % ; Open. Community Bank System | CBUStock Price | Live Quote | Historical Chart ; United Bankshares, , , % ; United Community Banks, , , %. Key facts today. Berkshire Hathaway has cut its stake in Bank of America Corp. (BAC) and Apple. After. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta Price. $ · Volume. , · Change. + · % Change. +% · Today's Open. $ · Previous Close. $ · Intraday High. $ · Intraday Low. $ Day High, Day Low, Week High, Week Low, Stock Chart. Sign up for email alerts. Data Provided by Refinitiv.

; Volume: M · 65 Day Avg: M ; Day Range ; 52 Week Range

Historical Prices for Bank of America ; 08/08/24, , , , ; 08/07/24, , , , traded funding issues. VLYAs of August 23, Close. $ Stock Price. $ %. Change. 8,, Volume. Today. - N/A. 52 Week Range. The bid & ask refers to the price that an investor is willing to buy or sell a stock. Register for your free account today at ufa656.site Nasdaq. Stock analysis for World Bank Group/The (Z:US) including stock price Bloomberg L.P. All Rights Reserved. Get unlimited access today. Explore. Bank of America Corp BAC:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/17/24 · 52 Week Low Stock Quote ; Today's High. $ ; Today's Low. $ ; 52 Week High. $ ; 52 Week Low. $ Stock Quote & Chart · Price · Volume · May '24 · $20 · 0M · Stock Price Information (CFG) ; Time. Price. Volume ; PM. , ; PM. , ; PM. 80, ; PM. 30, Today ; Last. ; Volume. m ; $ Chg. ; % Chg. % ; Open. The bid & ask refers to the price that an investor is willing to buy or sell a stock. Register for your free account today at ufa656.site Nasdaq. Price History Bank of America Corporation New York Stock Exchange: BAC Adjusted: Splits and Dividends Currently selected:Adjusted: Splits and Dividends. Stock Quote ; Change; + (+%) ; Volume; , ; Today's Open; $ ; Previous Close; $ Major Banks Stocks · Dave Inc - Ordinary Shares - Class A DAVE. Price: $ Daily change: $ · Grupo Supervielle S.A. - ADR SUPV. Price: $ Daily change. Bank of America Corp. · AT CLOSE PM EDT 08/23/24 · USD · % · Volume45,, Stock analysis for World Bank Group/The (Z:US) including stock price Bloomberg L.P. All Rights Reserved. Get unlimited access today. Explore. View today's Bank of America Corp stock price and latest BAC news and analysis. Create real-time notifications to follow any changes in the live stock. Community Bank System | CBUStock Price | Live Quote | Historical Chart ; United Bankshares, , , % ; United Community Banks, , , %. Key facts today. Berkshire Hathaway has cut its stake in Bank of America Corp. (BAC) and Apple. After. Chart graphic. Interactive stock chart provided by quotemedia FrequencyM © quote media. 1D; 5D; 1M; 3M; 6M; 1Y; 2Y; 3Y; 5Y; 10Y. Detailed Information. Today. Today. - N/A At certain places on this site, you may find links to web sites operated by or under the control of third parties. Fulton Bank.

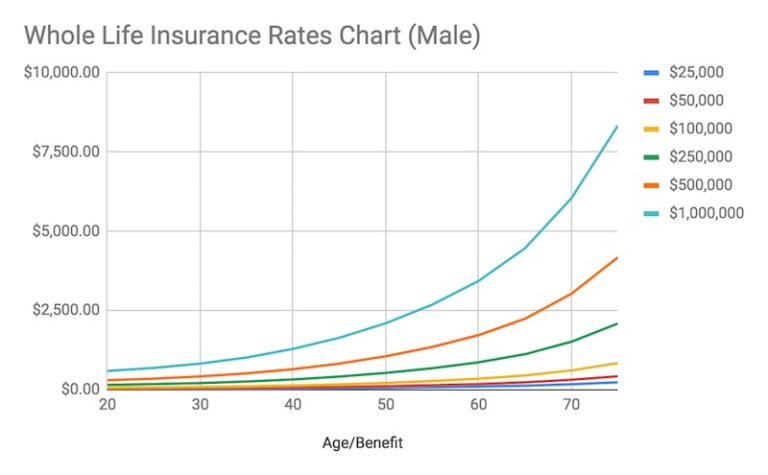

Life Insurance Commission Rates

They receive a salary and commissions based on their sales performance. For instance, a captive agent might earn a 10% commission on a $1, policy, resulting. You do not pay insurance agents directly. Instead, every time you make a premium payment, the insurance carrier pays the set commission rate to the agent or. Typically, a life insurance agent receives anywhere from 30% to 90% of the amount paid for a policy (also known as the premium) by the client in the first year. The average insurance commission is about 10%, but it can vary depending on the type of insurance and the company that you work for. Cincinnati Life Insurance Co.-Life. ProductName. Yr 2 Ren. Excess. FYC. Plan. Type Preferred Producer commissions available to agents with higher production. Assurity® Life Insurance Company. Post Office Box , Lincoln, NE Beginning with the second policy year, the standard renewal commission rates and. Let's say your commission rate on these policies is 30%, so you would receive $ that year, just for those 12 people. Because an insurance agent's salary is. The average commission rate for insurance agents ranges from 10% to 20%, with some agents earn as much as 30% or more. For example, if an agent sells a policy. If the average commission rate for an insurance sales agent on commission is 10 to 20 percent of the premium cost, for example, salespeople with a salary plus. They receive a salary and commissions based on their sales performance. For instance, a captive agent might earn a 10% commission on a $1, policy, resulting. You do not pay insurance agents directly. Instead, every time you make a premium payment, the insurance carrier pays the set commission rate to the agent or. Typically, a life insurance agent receives anywhere from 30% to 90% of the amount paid for a policy (also known as the premium) by the client in the first year. The average insurance commission is about 10%, but it can vary depending on the type of insurance and the company that you work for. Cincinnati Life Insurance Co.-Life. ProductName. Yr 2 Ren. Excess. FYC. Plan. Type Preferred Producer commissions available to agents with higher production. Assurity® Life Insurance Company. Post Office Box , Lincoln, NE Beginning with the second policy year, the standard renewal commission rates and. Let's say your commission rate on these policies is 30%, so you would receive $ that year, just for those 12 people. Because an insurance agent's salary is. The average commission rate for insurance agents ranges from 10% to 20%, with some agents earn as much as 30% or more. For example, if an agent sells a policy. If the average commission rate for an insurance sales agent on commission is 10 to 20 percent of the premium cost, for example, salespeople with a salary plus.

He made several inquiries regarding the receipt of commissions, fees, and expense allowances by general agents and producers of life and health insurance, as. How much can insurance agent make? · Commissions will vary from company to company and types of plans being sold to new clients. · Commissions for renewal of old. Find out what you would have to pay for Group Insurance Commission (GIC) benefits Optional Life Insurance · Buy Out Rates For Active Employees. Although there is no sales commission on these policies, the company will still have charges built into the premium to cover its marketing expenses, application. In general, a life insurance company will pay % to % of first year base premium in total commission to an agency. Yes, it gets complicated. Commission rates on life insurance products may be negotiated depending on group size. *Products and services marketed under the Dearborn National® brand. The average commission for life insurance brokers falls within the range of 7% to 15%. Commission rates can be higher for the first year, often between 80% and. Life insurance commissions have two tiers – the base commission, and the 'override'. Base commission is fixed per product, per company and is effectively a. Commissions for Group Voluntary Insurance Products. The Standard offers a competitive commission structure Life Insurance Company of New York, and shall. He made several inquiries regarding the receipt of commissions, fees, and expense allowances by general agents and producers of life and health insurance, as. This calculator will help you calculate your commission on insurance policies sold through The Standard. Life. Enter Premium. Commission. $0. YTD Estimated. The average commission rate for insurance agents ranges from 10% to 20%, with some agents earn as much as 30% or more. For example, if an agent sells a policy. AIG Commercial and Personal Insurance companies compensate insurance brokers and independent insurance agents through commissions. Commission Schedule. MassMutual. 10 YLT. Vantage Term 42%. MassMutual. 15 Term Life Answers 20 ‐ 85%. Zurich. IUL. Zurich Accumula on, Protec on. How Much Do Commission Life Insurance Agent Jobs Pay per Year? · $18, - $29, 13% of jobs · $29, - $40, 5% of jobs · $41, - $52, 4% of jobs. Retention Plan for Closed Workers' Compensation Commission Claims Files · Annual Flood Notice · IB - Homeowners' and Automobile Insurance Rates. Because commissions are removed from the VUL purchase, cash value can grow at a faster rate, giving clients more long-term growth potential. How to Think About. Insurance commission is a fee paid to an insurance agent or broker for selling insurance policies. It is a form of compensation for the services they provide. Commissions can vary widely, but it's common for independent carriers to pay to% on new business and to% on renewals.

Lifegreen Checking Minimum Balance

Regions Lifegreen Preferred checking requires a minimum initial deposit of $ Minimum Daily Balance to Avoid Monthly Fee, Starting at $5, Minimum. pm. Regions Bank is a · in , up from $ · the annual savings bonus, your · with no balance requirements. These · each specific case you encounter. · Fees. A $ deposit is required to open this account. $; Monthly Service Fee Note. The Monthly Service Fee of $ can. Make $1, or more of qualifying ACH direct deposits to your new LifeGreen checking account that must post within 90 days of account opening. Deposits must be. Teen Checking Account Feature & Benefits. The minimum opening deposit amount for opening a LifeGreen Savings Account is $50 (or $5 in branch if you set up a. Live green, earn green. Click to open a LifeGreen® checking account and learn how to earn a $ bonus. There is a low monthly fee of $5, but if you want to avoid that small charge, you can maintain a minimum daily balance of at least $ You can set up. LifeGreen Checking. Account Features: Opening Deposit Requirements: $ Minimum Balance: No Minimum Required. X. Checks. X. Debit Card. X. Bill Pay. Fees. "LifeGreen Simple Checking" fromRegions Bank. Website · The Basics. Minimum Opening Deposit balance is below $0 and more. Included with Online. Regions Lifegreen Preferred checking requires a minimum initial deposit of $ Minimum Daily Balance to Avoid Monthly Fee, Starting at $5, Minimum. pm. Regions Bank is a · in , up from $ · the annual savings bonus, your · with no balance requirements. These · each specific case you encounter. · Fees. A $ deposit is required to open this account. $; Monthly Service Fee Note. The Monthly Service Fee of $ can. Make $1, or more of qualifying ACH direct deposits to your new LifeGreen checking account that must post within 90 days of account opening. Deposits must be. Teen Checking Account Feature & Benefits. The minimum opening deposit amount for opening a LifeGreen Savings Account is $50 (or $5 in branch if you set up a. Live green, earn green. Click to open a LifeGreen® checking account and learn how to earn a $ bonus. There is a low monthly fee of $5, but if you want to avoid that small charge, you can maintain a minimum daily balance of at least $ You can set up. LifeGreen Checking. Account Features: Opening Deposit Requirements: $ Minimum Balance: No Minimum Required. X. Checks. X. Debit Card. X. Bill Pay. Fees. "LifeGreen Simple Checking" fromRegions Bank. Website · The Basics. Minimum Opening Deposit balance is below $0 and more. Included with Online.

Open any LifeGreen® checking account online using promo code PD19Q4 or present a personalized voucher in branch. Minimum opening deposit is $ To get $ A QUICK GUIDE TO YOUR REGIONS LIFEGREEN CHECKING FOR STUDENTS ACCOUNT Generally, we track two balances for your account: a posted balance and an available. Beyond that, the account doesn't come with a minimum balance requirement, provides a Visa Platinum Debit Card and offers free unlimited check writing. Plus, the. APYs are below average. · The money market and checking accounts have high minimum balance requirements to avoid their monthly fees. · The savings account only. Opening any LifeGreen Checking account requires a $50 minimum deposit. The balance legal disclaimer number1 in your LifeGreen Checking account. OR. LifeGreen Checking accounts require a $50 minimum opening deposit. The Monthly Fee for LifeGreen Checking accounts is $8 with online statements or $10 with. Checking: Regions LifeGreen Checking Opening requirement: $50 Monthly Fee: $10 Avoid Fee: Direct Deposit (at least one payroll or government direct. Maintain $15, minimum daily balance in your linked BankUnited consumer deposit accounts. $ Avoid the monthly fee with the following each monthly statement. Beginning Balance $ - Minimum Balance $4 - Deposits & Credits $3, + Average Balance $ Withdrawals $3, - Fees $ - Automatic. To qualify for a LifeGreen Savings Account, you must have a Regions checking account. You'll need to deposit at least $, to earn the minimum bonus of. Opening any LifeGreen Checking account requires a $50 minimum deposit. The balance legal disclaimer number1 in your LifeGreen Checking account. OR. LIFEGREEN CHECKING FOR STUDENTS: OVERDRAFT SERVICE OPTIONS. If your available balance is not enough to pay for a transaction, overdrafts may occur. Regions. $ minimum deposit to open. Available to students under age Avoid the $3 monthly account fee by enrolling in My Synovus2 digital banking and paperless e-. Checks $ - Ending Balance $ DEPOSITS & CREDITS. 03/21 ATM Deposit 03/23 Deposit Online Banking Transfer from 03/28 Deposit. All Little Rock Locations. Life Green Checking – No minimum balance or monthly fees with direct deposit or online statements. Life Green Savings – Free account. Totally Free Checking comes with no monthly maintenance fee – without a minimum balance or other requirements. It's the perfect, basic checking account. You can find online checking accounts with cashback rewards or no minimum balance For example, the LifeGreen Checking account has a $8 monthly fee that. To qualify for a LifeGreen Savings Account, you must have a Leon checking account. The minimum opening deposit amount for a Leon checking account is $ APYs are below average. · The money market and checking accounts have high minimum balance requirements to avoid their monthly fees. · The savings account only. Regions Bank LifeGreen Checking for Students These accounts do not have a minimum balance requirement although they do require a student to deposit $50 to.

Can I Continue To Contribute To A Rollover Ira

The only difference is that money in a rollover IRA can later be rolled over Yes, you can make contributions to your IRA, subject to the IRS annual. If you decide to roll over your TSP assets to an IRA, you can choose either a traditional IRA or Roth IRA. No taxes are due if you roll over assets from a. However, you can still contribute to a Roth IRA and make rollover contributions to a Roth or traditional IRA regardless of your age. A Rollover IRA is an individual retirement account that enables you to transfer and consolidate assets from an employer-sponsored retirement plan, such as a But a related provision that received less attention allows account owners to continue making contributions to traditional IRAs after they reach the required. If you choose to leave the funds in the (a) but you job, you'll no longer be able to contribute to the plan, but funds already in the plan will continue to. No, your rollover doesn't count as a contribution for the year. You can contribute additional money to your rollover IRA in the year that you open it. This. Certainly. You may have ten of them if you want to. However the limit on how much you may contribute each year applies to all of them together. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and earnings can grow tax-free. · You are. The only difference is that money in a rollover IRA can later be rolled over Yes, you can make contributions to your IRA, subject to the IRS annual. If you decide to roll over your TSP assets to an IRA, you can choose either a traditional IRA or Roth IRA. No taxes are due if you roll over assets from a. However, you can still contribute to a Roth IRA and make rollover contributions to a Roth or traditional IRA regardless of your age. A Rollover IRA is an individual retirement account that enables you to transfer and consolidate assets from an employer-sponsored retirement plan, such as a But a related provision that received less attention allows account owners to continue making contributions to traditional IRAs after they reach the required. If you choose to leave the funds in the (a) but you job, you'll no longer be able to contribute to the plan, but funds already in the plan will continue to. No, your rollover doesn't count as a contribution for the year. You can contribute additional money to your rollover IRA in the year that you open it. This. Certainly. You may have ten of them if you want to. However the limit on how much you may contribute each year applies to all of them together. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and earnings can grow tax-free. · You are.

If you already have an IRA you can go right to Step 2. You may have both pre-tax Traditional and post-tax Roth contributions that could require two new IRA. If you already have an IRA you can go right to Step 2. You may have both pre-tax Traditional and post-tax Roth contributions that could require two new IRA. Yes, you can, but only if you have taxable compensation. Roth IRAs were designed to help people save for retirement with the advantage of tax-free growth. Rolling over your retirement plan assets to an IRA allows you to continue to defer federal income taxes and avoid the 10% early withdrawal penalty. day rollover – If a distribution from an IRA or a retirement plan is paid directly to you, you can deposit all or a portion of it in an IRA or a retirement. You can continue contributing to your rollover IRA. But there are rules While your earnings affect how much you can contribute to a Roth IRA, there. DCP now offers a Roth or pretax option. Each option affects when your retirement contributions will be taxed. What is pretax? With the DCP pretax option. However, numerous (k) plans allow employees to transfer funds to an IRA while they are still with their employer. contributions will significantly impact. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. A rollover IRA offers a great way to consolidate multiple accounts into one IRA. Note that many types of retirement accounts, not just workplace plans, can be. Once you have one open, not only can you roll money into the account from other retirement plans, but you can also continue contributing up to the annual. An IRA would get you more investment options, and you can opt for a traditional or Roth IRA. · Converting to a Roth IRA will mean paying income taxes on the. All retirees can contribute to traditional IRAs if they earn income, according to the SECURE Act of · Retirees can continue to contribute earned funds to a. You can make contributions to a rollover IRA, up to IRA contribution limits. For tax year , individuals can contribute up to $6, (with an additional. You might do an IRA rollover, for example, while still working at age 60 for your current employer. Now that you meet the minimum age requirement for. You have a wider choice of investments. · You can consolidate your retirement investments. · You can continue making contributions to a rollover IRA. · You can. Beginning with the tax year , anyone with earned income is able to contribute to their rollover IRA. Contribution Deadline and Limits. The maximum annual. Most IRA rollover accounts allow you to make additional contributions—beyond the initial rollover amount—without having to open a separate IRA account. And. Rolling your existing workplace and IRA accounts into a single IRA can make it easier to track and pursue your retirement goals. Boost your retirement. You have to make a contribution for the five-year time period to start. The problem is that not everyone is eligible to do so. The ins and outs.

Va Loan Rates Based On Credit Score

Adjust the graph below to see historical VA mortgage rates tailored to your loan program, credit score, down payment and location. LOAN PROGRAMS. 30 year. When you have a credit score of and above, you're typically going to be first in line for the best rates possible. However, this doesn't mean that lower. The article mentions that private lenders determine interest rates based on credit scores, but it does not provide specific examples or a range of interest. Most VA lenders require a minimum credit score of at least The exact requirement may be higher or lower, depending on the lender. NewCastle Home Loans. Mortgage rates as of August 22, ; % · % · % · % ; $1, · $1, · $1, · $1, Estimated monthly payment and APR calculation are based on a down payment of 0% and borrower-paid finance charges of % of the base loan amount, plus. VA mortgage rates today, August 24, , start at % (% APR) for a year fixed-rate loan. Average rates are based on a daily survey of our lender network. The average VA loan interest rate as of July 8, is % for a year fixed mortgage. The average VA loan interest rate as of August 21, is % for. Credit score. While the VA doesn't require borrowers to have a minimum credit score, lenders do consider your score and offer lower rates to those with higher. Adjust the graph below to see historical VA mortgage rates tailored to your loan program, credit score, down payment and location. LOAN PROGRAMS. 30 year. When you have a credit score of and above, you're typically going to be first in line for the best rates possible. However, this doesn't mean that lower. The article mentions that private lenders determine interest rates based on credit scores, but it does not provide specific examples or a range of interest. Most VA lenders require a minimum credit score of at least The exact requirement may be higher or lower, depending on the lender. NewCastle Home Loans. Mortgage rates as of August 22, ; % · % · % · % ; $1, · $1, · $1, · $1, Estimated monthly payment and APR calculation are based on a down payment of 0% and borrower-paid finance charges of % of the base loan amount, plus. VA mortgage rates today, August 24, , start at % (% APR) for a year fixed-rate loan. Average rates are based on a daily survey of our lender network. The average VA loan interest rate as of July 8, is % for a year fixed mortgage. The average VA loan interest rate as of August 21, is % for. Credit score. While the VA doesn't require borrowers to have a minimum credit score, lenders do consider your score and offer lower rates to those with higher.

Today's VA Home Loan Rates ; %, %, % ; %, %, % ; %, %, % ; %, %, %. Rates displayed are "as low as" and effective 08/25/ for purchase, refinance loans, and VA IRRRL, and require a % loan origination fee, which may be. Is there a minimum credit score required on a VA loan? While the VA does not require a minimum credit score, having a score of or higher can help secure a more favorable rate. Your debt-to-income (DTI) ratio. What credit score do you need for a year VA mortgage loan? Most qualified VA lenders look for credit scores to be or higher. Talk with a U.S. Bank. VA does NOT require a minimum credit score, but most lenders will use a credit score to help determine your interest rate and to lower risk. Typically, lenders. Thanks to the government insurance of these mortgages, lenders are able to offer competitive VA loan rates that are usually lower than conventional mortgages. The average credit score for a VA home mortgage is right around to VA loan lenders use your credit score to help determine the APR rate you will. As your credit score gets higher the APR rate savings diminish, such as a credit score of , or for a $, VA home loan may have a monthly payment. In addition to these service requirements, you must also meet lender guidelines related to credit score, debt-to-income ratio, and other financial factors. VA. Whether your credit score is or , you're going to pay a lot less interest with a VA loan. Basically, if you want to get a feel for how much a VA home. Typically, a FICO® credit score of is the baseline number to qualify. While other institutions adjust their VA rate based on your credit score, at SCCU. The U.S. Department of Veterans Affairs doesn't set a specific VA loan credit score requirement. Lenders, however, can set their own minimum requirements. Rates as of Aug 24, ET. The interest rate above shows the option of purchasing discount points to lower a loan's interest rate and monthly payment. One. VA Mortgage Rates · year Fixed-Rate VA Loan: An interest rate of % (% APR) is for a cost of Point(s) ($5,) paid at closing. · year Fixed. Median Credit Score. A credit score requirement means you don't need perfect credit to get a VA loan. 2. Certificate of Eligibility (COE). You'll need. Interest rates: Rates fluctuate based on market conditions and vary based on your FICO score and overall financial profile. Know the rate upfront so you can. The VA does not set a minimum credit score for the VA loans it guarantees. Instead, it asks lenders to look at the full loan profile of the person applying for. Instead, the VA relies on lenders to ensure borrowers are a satisfactory credit risk. VA lenders typically require a FICO score of at least High loan. Rates data is based on a borrower with good credit, a conforming loan What Credit Score Is Needed for a VA Loan? The VA does not have a minimum.